0415453721

info@info@assurancelifepro.com.au

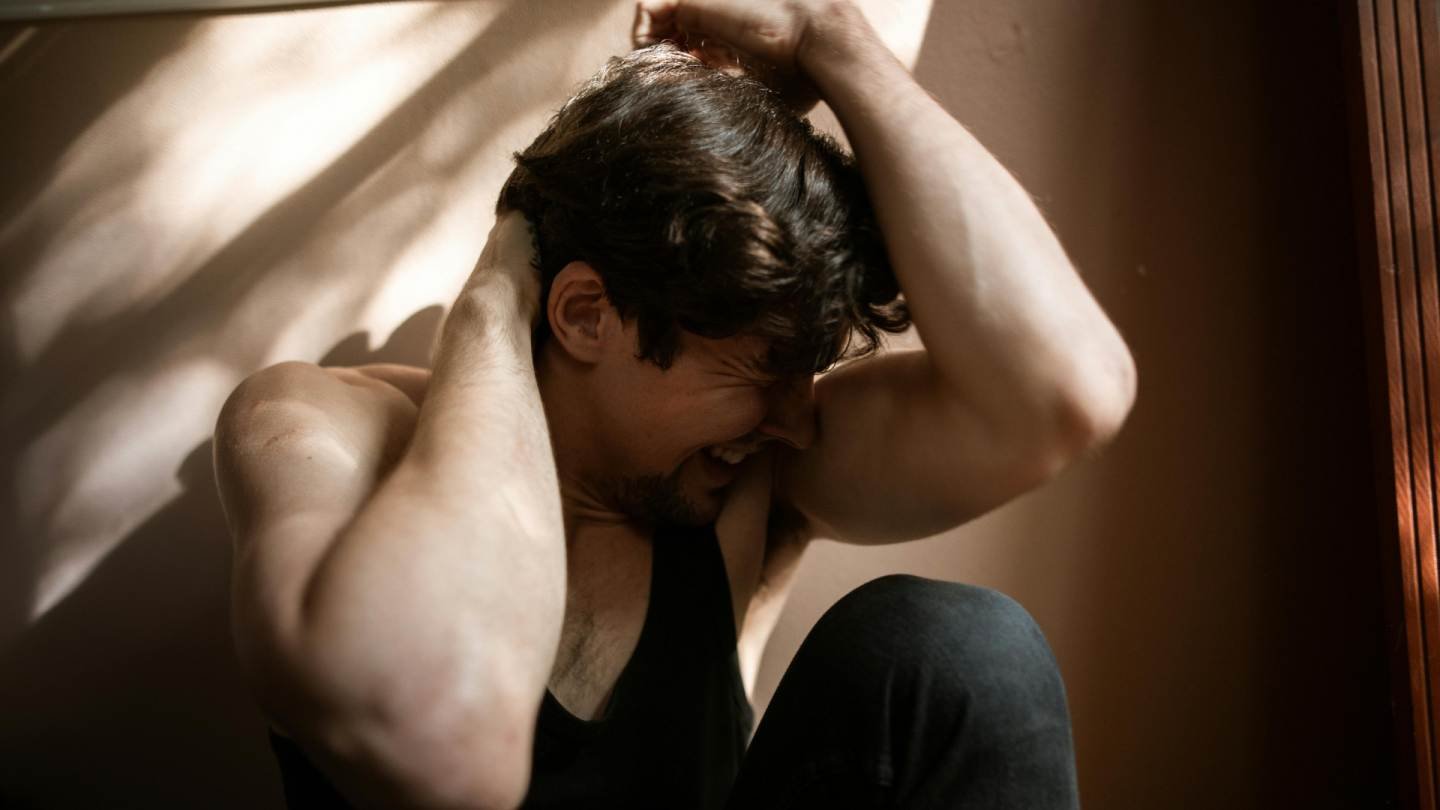

Modern medicine is incredible. It means that if you suffer a heart attack, stroke, or cancer diagnosis today, you are more likely than ever to survive. But survival comes at a cost. While you focus on fighting the illness, your bills—mortgage, school fees, utilities—keep arriving.

At Assurance Life Pro, we believe your recovery should be focused on your health, not your bank balance. As your dedicated Trauma insurance broker, we specialise in protecting your lifestyle from the financial shock of a major medical event. We help you obtain and compare trauma insurance quotes from Australia’s leading insurers, ensuring you have a tax-free cash injection exactly when you need it most.

Trauma Insurance (often called Critical Illness or Recovery Insurance) pays a lump sum of money if you are diagnosed with a specific medical condition listed in the policy—most commonly Cancer, Heart Attack, Stroke, or Coronary Bypass Surgery.

Many Australians ask, “Doesn’t Medicare or Private Health cover this?” The answer is No.

Medicare/Private Health pays the doctors and hospitals.

Trauma Insurance pays you.

It is cash in your hand to use however you see fit. Whether it’s paying down the mortgage to relieve stress, funding non-PBS medication that costs $5,000 a month, or simply taking a year off work to recover without pressure, Trauma Insurance Australia-wide is the bridge between diagnosis and full recovery.

The statistics are confronting: 1 in 2 Australian men and 1 in 3 women will be diagnosed with cancer by age 85. If you rely on your income or have debt, you are at risk.

If one partner falls ill, the household income often drops to zero—the sick partner stops working, and the healthy partner takes time off to care for them. A Trauma payout can clear a chunk of the mortgage instantly, ensuring the family home is safe while you navigate chemotherapy or rehabilitation.

If you run a business, a major illness can be catastrophic. Trauma cover provides the liquidity to hire a locum or manager to keep the doors open while you recover. It protects the business you built from collapsing due to your health.

If you are single, you don’t have a partner’s income to fall back on. If you stop working, the bills pile up immediately. Affordable trauma cover is your personal safety net, ensuring you can afford the best treatment and rehabilitation without depleting your life savings.

When you look for Trauma insurance quotes, price is only half the story. The “Medical Definitions” are what determine if you get paid.

Direct insurers often use outdated or strict definitions (e.g., requiring a heart attack to be of a certain severe “enzyme level” to pay out). As a specialist Trauma insurance broker, we recommend policies with:

Tiered Definitions: Paying partial amounts for early-stage cancers (e.g., carcinoma in situ) rather than waiting for it to become life-threatening.

Future-Proofing: Policies that automatically upgrade definitions if medical technology improves.

Claims Advocacy: We fight for your claim. If a doctor’s report is ambiguous, we work with specialists to prove your diagnosis meets the policy terms.

The primary benefit of Trauma Insurance is Choice.

Access Best Treatment: You can afford top-tier specialists or overseas treatment options not available publicly.

Lifestyle Modification: Funds to renovate your home or move to a single-storey property if mobility becomes an issue.

Debt Reduction: Eliminate credit card debt or car loans instantly to reduce monthly outgoings.

We streamline the search for the right cover:

Gap Analysis: We look at your debts and living costs to recommend a Sum Insured (e.g., $100k, $200k, or $500k).

Market Comparison: We compare trauma insurance premiums across the market (TAL, AIA, Zurich, NEOS) to find the “sweet spot” between cost and coverage quality.

Pre-Assessment: If you have family history (e.g., parents with heart disease), we anonymously check with underwriters to see which insurer will offer you the best terms without exclusions.

Protection: Your policy is issued, giving you immediate peace of mind.

Eligibility & Application Steps

Trauma Insurance is strictly underwritten because the risk of claiming is higher than Life Insurance.

Age: Typically available for ages 18 to 60 (expiring at age 70).

Family History: You will be asked about the medical history of your parents and siblings.

Health Status: BMI, smoker status, and blood pressure are key factors.

Note: If you have had cancer previously, you may not be able to get cancer cover, but we can often still secure cover for Heart & Stroke.

Don’t wait for a diagnosis to value your health.

Generally, No. Unlike Income Protection, Trauma Insurance premiums are not tax-deductible for individuals, because the lump sum payout is tax-free. However, if the policy is owned by a business for "Key Person" purposes, the tax rules differ. We can work with your accountant to structure this correctly.

Standard policies cover around 30 to 50 conditions. The "Big 4" account for about 90% of claims: Cancer, Heart Attack, Stroke, and Coronary Bypass Surgery. Other common conditions include Kidney Failure, Major Head Trauma, MS, and Blindness. As your Trauma insurance broker, we provide a full Product Disclosure Statement (PDS) listing every covered event.

It is difficult. Current legislation prevents Super funds from releasing money for many Trauma conditions (like early-stage cancer) because they don't meet the condition of "permanent incapacity." Therefore, most Trauma policies must be held personally.

Broker Solution: We can set up a "Super-Linked" policy where the Life/TPD portion is paid by Super, and the Trauma portion is paid by you personally, keeping costs manageable while ensuring the payout is legally accessible.

There is no fixed rule, but a common strategy is to cover 2 years of income + $50,000 for medical costs. This gives you a two-year runway to recover without needing to work. For a mortgage holder, covering 50% or 100% of the mortgage is also a popular strategy to ensure debt security.

This is a crucial feature we recommend. If you claim $500k for Cancer, your cover usually ends. A "Buy Back" option allows you to reinstate your cover (usually 12 months later) for other events. So, if you suffer a Heart Attack 3 years after your Cancer claim, you can claim the full $500k again. Without this option, you would be uninsurable after the first claim.